My guest on the show today is Balkar Sivia, Founder & Portfolio Manager at White Falcon Capital Management. In this episode, Balkar shares his unique path from engineering to investing, and why he built White Falcon around an unconstrained, opportunistic philosophy — one that rejects traditional style boxes like “growth” or “value.”

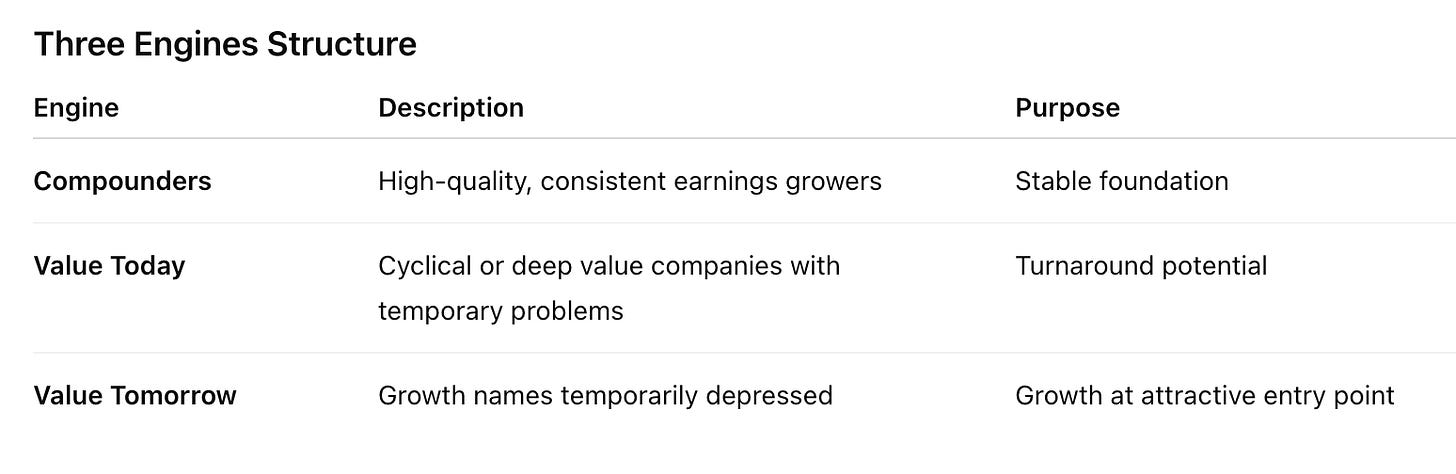

We dive into White Falcon’s three “engines” — Compounders, Value Today, and Value Tomorrow — and how, for Balkar, this structure should result in part of the portfolio always working. Balkar walks through case studies, explaining how he looks for quality businesses facing temporary challenges, and how narrative shifts and multiple expansion drive returns over a three-year horizon.

We also discuss the lessons he’s learned in managing value traps, how he’s thinking about AI as an investor, and the importance of evolving your process over time. At the heart of it all is a focus on quality management, incentives, and high-conviction positions in a concentrated 20-stock North American portfolio.

For more information about White Falcon Capital Management, please visit:

https://www.whitefalconcap.com/

You can Follow Balkar Sivia on Twitter/X @WhiteFalconCap: https://x.com/whitefalconcap

Watch on YouTube:

Summary:

Inspired by Warren Buffett’s early partnership, White Falcon’s portfolio is structured around three “engines”:

Compounders – core high-quality holdings

Value Today – deep value situations facing temporary issues

Value Tomorrow – growth companies with depressed valuations

This framework ensures some portion of the portfolio is always performing while allowing dynamic capital allocation. The goal: identify businesses where the narrative can shift positively over three years, generating returns from both earnings growth and multiple expansion.

1. Background and Firm Genesis

Non-traditional start: Began as an engineer, investing his paychecks before transitioning into finance.

Experience:

Worked with Tim Maldane in Vancouver (protégé of deep value investor Peter Kundle).

Spent 8 years at Burgundy Asset Management (Toronto), focusing on quality value.

White Falcon founded November 2021: Peak of the market, driven by his desire to run a portfolio and to escape restrictive “industry boxes.”

2. Core Investment Philosophy: Unconstrained and Opportunistic

Rejects rigid labels (e.g., large-cap growth, small-cap value).

Inspired by Buffett/Munger’s “do whatever it takes” approach.

Ultimate Goal: Within three years, capture earnings growth + multiple expansion through narrative shifts.

3. The Investment Process: Quality and Conviction

Universe: North America.

Portfolio: ~20 highly concentrated stocks → demands high conviction.

Quality defined: Management and culture matter “equally or more” than moats or capital returns.

Diligence Process:

Monitor earnings and IR contacts.

Deep dive when stock falls on temporary issues.

Consult expert networks on culture/business quality.

Final call with management before investing.

4. Case Studies

Grifols (GRFS) – Quality Through a Perfect Storm

Plasma derivatives oligopoly, high barriers.

Hit by supply shortages and governance questions.

Brookfield bid signaled quality, board action addressed governance.

Valuation: ~10x EBITDA vs historical 12–15x.

Rentokil (RTO) – “Value Today” Turnaround

Pest control, recurring revenues, route density moat.

Merger with Terminix poorly executed → discount to peer Rollins (ROL P/E 50 vs RTO 16).

Catalyst: Nelson Peltz activist role + management turnover.

Potential to re-rate from turnaround to compounder.

Endava (DAVA) – Managing Value Traps

IT outsourcing, bought after big drop.

Disruption: macro slowdown + AI uncertainty.

Red flag: repeated broken guidance.

Sold to preserve “mental capital.”

5. Evolving Perspectives and Learnings

Value Traps: Don’t avoid at all costs, but cut quickly when thesis fails.

AI: Focus on “AI-adjacent” quality/value plays like AMD.

Investor Evolution:

Accept higher multiples for quality.

Lesson from dot-com bust: don’t abandon growth, but buy it cheap.

Focus on unit economics over GAAP profit in select SaaS names.

6. Concluding Advice

No Shortcuts: Hard work drives returns.

Primary Sources: Focus on filings (10-K, 10-Q).

Incentives Matter: Management pay structures dictate behavior.

Adaptability: Keep evolving, learning from mistakes, and refining process.

Planet MicroCap Podcast is on YouTube! All archived episodes and each new episode will be posted on the Planet MicroCap YouTube channel. I’ve provided the link in the description if you’d like to subscribe. You’ll also get the chance to watch all our Video Interviews with management teams, educational panels from the conference, as well as expert commentary from some familiar guests on the podcast.

Subscribe here: http://bit.ly/1Q5Yfym

Click here to rate and review the Planet MicroCap Podcast

The Planet MicroCap Podcast is brought to you by SNN Incorporated, The Official MicroCap News Source, and the Planet MicroCap Review Magazine, the leading magazine in the MicroCap market.

You can Follow the Planet MicroCap Podcast on Twitter @BobbyKKraft