My guest on the show today is Jason Kirsch, Portfolio Manager at Rosen Partnership and co-architect of the firm’s Active Value Strategy — a concentrated, long-only, private-owner-style approach to investing in micro-cap companies across Canada, the U.S., and Europe.

In this episode, Jason walks us through Rosen Partnership’s philosophy of thinking like private owners in the public markets: buying capital-light, high-ROIC compounders at meaningful discounts to intrinsic value; partnering with aligned management teams; and using “constructivism” — a collaborative, non-activist engagement style — to help unlock long-term value.

We dig deep into how Jason builds a true knowledge edge: talking not just to management, but to former executives, board members, competitors, suppliers — anyone who can broaden the mosaic and create an informational gap most investors simply aren’t willing to develop. Jason also shares lessons learned from catalysts that didn’t play out, how misaligned incentives can turn a bargain into a value trap, and why understanding your own psychology is just as important as understanding any business.

For more information about Rosen Partnership, please visit: https://www.rosenpartnership.com/

We just announced our full slate of investor conferences for 2026, all in partnership with MicroCapClub. Our next major event is Planet MicroCap: LAS VEGAS, happening June 16–18, 2026, at the Bellagio. Registration is now open for that. And, later in the year, we’ll be heading back to Toronto, October 27-29, 2026 at the Arcadian Loft. The mission is to bring the best microcap investors and companies together to gather, connect, and grow. This includes your participation.

We know you are putting your 2026 investor conference calendars together, and we’d like to humbly invite you to join us for one or both of them. Please visit www.planetmicrocapshowcase.com for more information. See you in Vegas and Toronto!

Watch on YouTube:

Summary:

The core of the firm’s approach is the Active Value Strategy, a concentrated, long-only portfolio focused on micro-cap companies (under $1 billion market cap) across Canada, the U.S., and Europe.

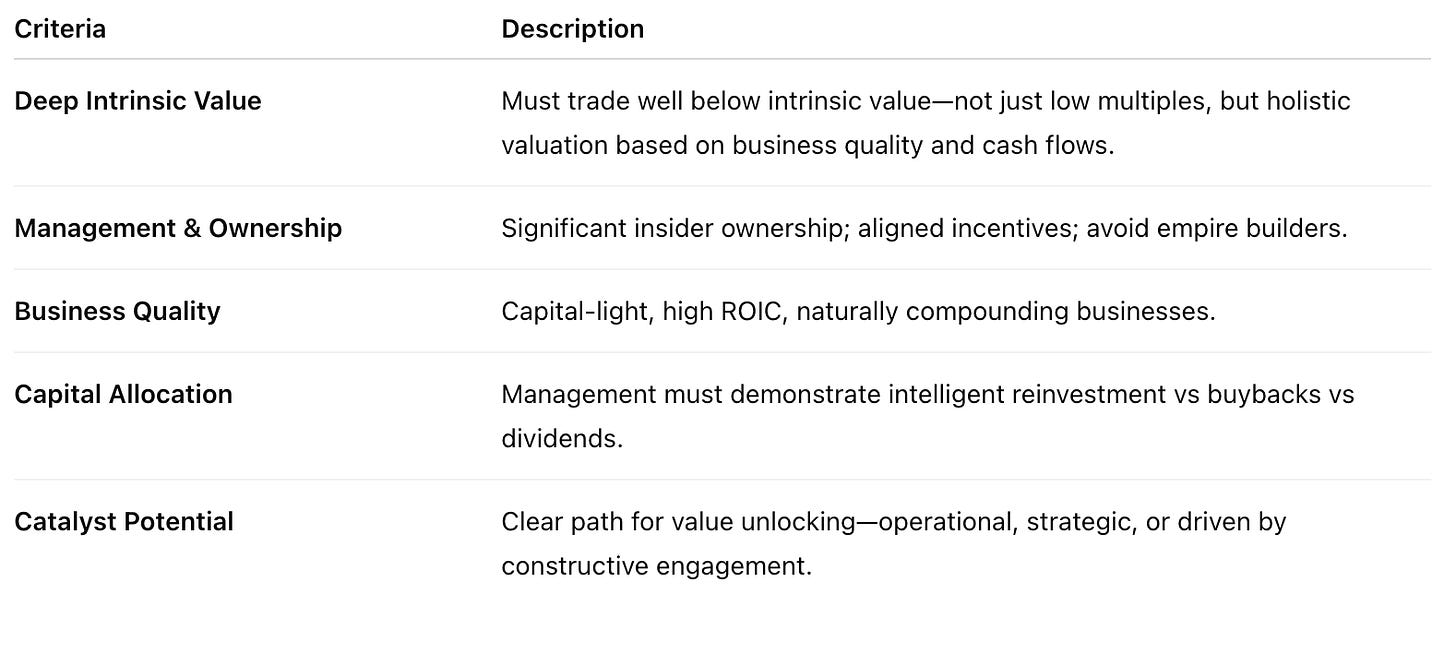

The strategy is rooted in thinking like a private owner of a public company, seeking long-term compounders trading at meaningful discounts to intrinsic value. Key criteria include:

High returns on invested capital

Capital-light business models

Management teams with significant “skin in the game”

Clear, thoughtful capital allocation

The investment process is exhaustive, extending research beyond management to former employees, board members, competitors, and suppliers. This depth of work is intended to create a “knowledge gap” that provides an edge. A defining feature of the firm’s approach is constructivism—collaborative engagement with management to unlock value, while stopping short of formal activism.

Kirsch emphasizes that understanding oneself—biases, tendencies, reactions—is as essential as understanding the businesses themselves.

Jason Kirsch: Background and Formative Experiences

Kirsch’s philosophy is shaped by academic grounding, hands-on experience, and exposure to markets during periods of extreme stress.

Early Influences

Interest began in high school with a stock-picking competition.

Studied at McGill University in the Honors Investment Management program, where students launched and ran a regulated asset management firm.

Gained experience in both public markets and fixed income during the Great Financial Crisis, shaping his framework for risk and valuation.

Hedge Fund Experience

After graduating, Kirsch worked at three firms including Desautels Capital Management, Galliant Advisors, and Waratah Capital Advisors.

Key lesson:

“Learning the short side… you have to flip the script on every single name you’re looking at.”

This cultivated a deep appreciation for margin of safety, and the ability to analyze every investment from both long and short perspectives—discipline he brings into a long-only format today.

Founding the Strategy

In March 2022, Kirsch partnered with Brian Rosen to launch the Active Value Strategy.

Their catalyzing observation:

“Amazing opportunities—companies trading extraordinarily cheaply at huge discounts to their net asset value.”

The Rosen Partnership Active Value Strategy

A disciplined, research-heavy, concentrated approach centered on high-conviction ideas.

Core Philosophy

Concentrated portfolio: Typically ~10 names representing the majority of assets.

Geographic focus: Canada, the U.S., and increasingly Europe.

Private-owner mindset:

“Would we want to own this business privately at this price?”Investment goal: Own “fantastic businesses that compound naturally” and ideally never sell—potential three, five, or ten-baggers.

Key Investment Criteria

Investment Process and Due Diligence

A process designed to uncover overlooked ideas and develop a knowledge-based edge.

Sourcing

To build the strategy, the team:

“Looked through every single publicly traded name in Canada below a billion dollars.”

Deep Research

The goal is to build a knowledge gap from 90% of other investors by:

Speaking with current management and board members

Calling former CEOs, employees, and directors

Engaging suppliers, customers, and competitors (public and private)

Thesis Development

This involves constructing a mental model:

What the business is

How it truly makes money

Long-term potential

Outcomes with or without management execution

Position Building

Flexible approach:

Starter position on catalysts or news

Full diligence before waiting for an optimal entry point

Slow, deliberate accumulation (e.g., 3–5% ownership positions)

Shareholder Engagement: “Constructivism”

A major differentiator of the strategy.

Constructive Partnership

Kirsch prefers:

“Working constructively with management teams.”

The firm:

Shares research insights

Provides memos comparing the company with peers

Offers suggestions based on deep industry analysis

Understanding Incentives

Critical to alignment:

Managers may resist asset sales because “now the business is smaller,” which may conflict with shareholder value creation.

Challenges and Lessons Learned

The Catalyst Trap

A core risk:

Waiting too long for a catalyst that never materializes

Entrenched management or controlling shareholders can block value creation

Key lesson:

Ensure there is a clear path for a catalyst before investing.

Misaligned incentives = potential value trap.

Key Perspectives and Advice

On Market Cycles

A disciplined, long-term approach must be combined with awareness of the current cycle—supported by stable, long-term investors who understand the strategy.

On Expanding into Europe

Europe offers “phenomenal” opportunities:

Forgotten and under-followed companies

Attractive markets like the UK, Austria, and Poland

On Investor Psychology

Kirsch stresses:

“To be a great investor, you have to understand yourself.”

Advice for New Investors

The single most important trait:

“Be naturally curious.”

Curiosity drives:

Deep research

Knowledge advantage

Preparedness for opportunity

Continuous improvement

Planet MicroCap Podcast is on YouTube! All archived episodes and each new episode will be posted on the Planet MicroCap YouTube channel. I’ve provided the link in the description if you’d like to subscribe. You’ll also get the chance to watch all our Video Interviews with management teams, educational panels from the conference, as well as expert commentary from some familiar guests on the podcast.

Subscribe here: http://bit.ly/1Q5Yfym

Click here to rate and review the Planet MicroCap Podcast

The Planet MicroCap Podcast is brought to you by SNN Incorporated, The Official MicroCap News Source, and the Planet MicroCap Review Magazine, the leading magazine in the MicroCap market.

You can Follow the Planet MicroCap Podcast on Twitter @BobbyKKraft